GEICO car insurance: reviews, costs and coverage

GEICO Car Insurance

In Our Opinion:

We named GEICO “Best Overall” because of the company’s well-rounded offerings and positive scores across the board. GEICO makes it easy to get car insurance with a helpful mobile app and affordable plans for all drivers, including students and military members. Customers will enjoy the online experience but may be frustrated with repairs and the pace at which claims are handled.

Industry Standing

95

Availability

100

Coverage

95

Affordability

95

Customer Service

95

Online Experience

95

Pros

24/7 access to agents

Variety of discounts (some as high as 26%)

Convenient GEICO mobile app and online tools

Strong industry financials

Auto Repair Xpresss (ARX) repair facilities

Cons

Reports of slow claims processing

Average or inconsistent customer service

96

Compare Quotes

Considering an auto insurance policy with GEICO? In this article, we’ll take a close look at GEICO auto insurance reviews, costs, coverage options, and more. Find out how the auto insurer covers drivers and handles claims, as well as what real-life customers have to say about their plans. Then see why we named it the overall best auto insurance company in the industry.

GEICO auto insurance is available in all 50 states. To get a free quote from GEICO and other top insurers in your area, fill out the online form below.

GEICO Overview

GEICO Auto Insurance Coverage Options

Liability Insurance

Vehicle Coverage

Medical Coverage

Uninsured/Underinsured Motorist Coverage

Additional GEICO Auto Insurance Coverages

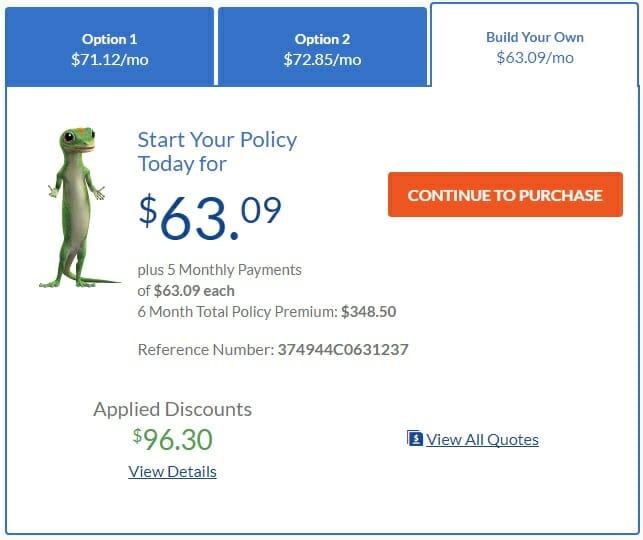

GEICO Auto Insurance Cost

How to Find Affordable GEICO Auto Insurance Plans

GEICO Auto Insurance Mobile App

What Is GEICO Voice?

Online Payments with GEICO Auto Insurance

GEICO Auto Insurance Reviews & Ratings

GEICO Car Insurance Customer Reviews

Conclusion: Best Overall Car Insurance

GEICO Overview

Founded in 1936 and currently headquartered in Chevy Chase, Maryland, GEICO is one of the biggest car insurance companies in the nation. Accounting for almost 14 percent of the U.S. market share, the insurer wrote just under 35 billion insurance premiums in 2019 alone. In addition to car insurance, GEICO offers policies for homeowners insurance, renters insurance, and more.

GEICO Auto Insurance Coverage Options

GEICO offers several types of car insurance, from basic coverage to comprehensive protection. See below for a detailed explanation of Geico coverage options and benefits.

Liability Insurance

Liability insurance is required in most states and covers other drivers in accidents where you are at fault.

Bodily injury liability insurance pays damages and costs associated with personal injuries and death.

Property damage liability insurance pays for damage to another person’s car or property.

GEICO also offers umbrella insurance for especially serious accidents. Umbrella coverage pays out up to $1 million for damages.

Vehicle Coverage

GEICO vehicle coverage includes two types of insurance:

Collision coverage pays for damage to your vehicle caused by a collision with another vehicle or object.

Comprehensive coverage covers damages not caused by a collision, such as theft, vandalism, or weather-related incidents.

Medical Coverage

GEICO medical coverage may pay for medical treatment, lost wages, and other expenses related to an accident. These costs are usually covered regardless of who is at fault.

Medical payments coverage (MedPay) helps pay for medical bills, including funeral expenses, as a result of an accident.

Personal injury protection (PIP) helps pay for medical bills as well as other accident-related expenses such as lost wages.

Uninsured/Underinsured Motorist Coverage

This form of insurance may cover your injuries or property damage when the driver at fault for an accident cannot be identified (such as in a hit-and-run), is uninsured, or does not have adequate insurance to pay the complete cost of damages.

Additional GEICO Auto Insurance Coverages

Rental reimbursement: This covers up to $25 per day for a maximum of $750 per claim.

Roadside assistance: Roadside assistance includes battery jump-start services, flat-tire changes, and lockout services (up to $100). With the GEICO mobile app, you can request help 24/7 and use a GPS locator to help emergency services find you.

Mechanical breakdown insurance (MBI): MBI coverage pays for car repairs after an unexpected breakdown that is not the result of an accident, similarly to an extended car warranty. This coverage lasts up to seven years or 100,000 miles. New or leased vehicles must be less than 15 months old and have fewer than 15,000 miles to be eligible for this type of policy.

GEICO Auto Insurance Cost

GEICO auto insurance rates can vary by state as well as several other factors, including age, marital status, driving history, and gender.

Though GEICO claims to have the best rates, the cost of GEICO auto insurance falls somewhere in the middle among competitors. But there are ways to lower the price of your premiums, especially if you can qualify for discounts. GEICO’s available discounts include:

Multi-Policy Discount: Varies

Military Discount: 15 percent

New Vehicle Discount: 15 percent

Multi-Vehicle Discount: 25 percent

Good Student Discount: 15 percent

Anti-Lock Brakes Discount: 5 percent

Federal Employee Discount: 8 percent

Anti-Theft System Discount: 25 percent

Membership/Employee Discount: Varies

Daytime Running Lights Discount: 1 percent

Emergency Deployment Discount: 25 percent

Good Driver Discount: 26 percent (no accidents for five years)

Seat Belt Use Discount: 15 percent off medical coverage or PIP

Drivers Education and Defensive Driving Course Discounts: Varies

Air Bag System Discount: 25 percent for driver’s side and 40 percent for full-front seat

Seniors are eligible for a GEICO “Prime Time” plan specifically designed for drivers older than 50. To be eligibl

e, drivers must have a clean driving record with no violations or accidents in the past three years. Furthermore, no drivers under age 25 can operate the covered vehicle.GEICO customers can protect themselves from rate increases after an accident through GEICO’s accident forgiveness program. Accident forgiveness can be purchased as an add-on and is also awarded to customers who stay accident-free for a certain period of time. This perk is not available to drivers in California, Connecticut, or Massachusetts.

Finally, drivers can who want to save on GEICO auto insurance policies can opt for a larger deductible to lower their insurance premiums.

How to Find Affordable GEICO Auto Insurance Plans

GEICO offers a free auto insurance quote engine, as well as a coverage calculator and a rate pricing comparison tool.

The coverage calculator helps car insurance shoppers find the right type of coverage based on a series of questions about driving habits, assets, and other factors.

The rate comparison tool allows shoppers to see how GEICO’s rates stack up against other major insurance companies.

GEICO Auto Insurance Mobile App

GEICO’s online experience is enhanced with the GEICO Mobile app. The app won awards in 2016 and 2019, as well as received several high rankings from the Dynatrace Scorecard, beating out other insurance mobile apps for its customization options and easy use.

The GEICO Mobile app allows users to:

Pay bills

Access digital ID cards

Request roadside assistance

Use Kate, a virtual assistant, to answer questions

View service history, maintenance schedules, and more with Vehicle Care from myCARFAX

Customers can even play an augmented reality game on the mobile app.

The company’s mobile app is a strong selling point and part of the reason why we pick GEICO auto insurance as best overall.

What Is GEICO Voice?

GEICO Voice allows customers to check their claim status or request roadside assistance (among other services) just by using their voice. This tool is compatible with Google Assistant and Amazon Alexa. We think this feature is a nice plus, as anyone who’s been in an accident knows how stressful filing a claim can be. Now you can just ask Alexa or Google for an update.

Online Payments with GEICO Auto Insurance

Customers can set up automatic payments or pay without logging in through GEICO Express Services. This tool lets you pay your bill or view your ID without having to enter a username and password. Instead, you use your zip code, phone number, policy number, or Social Security number.

GEICO also offers payment plans, so you can make payments with a credit card, debit card, check, or your saved checking account info.

GEICO Auto Insurance Reviews & Ratings

Better Business Bureau (BBB) Score: A+

BBB Customer Review Score: 1.14 / 5.0

Trustpilot Score: 1.6 / 5.0

AM Best Financial Strength Rating: A++

When it comes to industry ratings, GEICO performs well. According to the 2020 J.D. Power Auto Claims Satisfaction Study

SM, customers reported their experiences with their local agents and call center representatives as above average compared to other insurance companies like Esurance, State Farm, and USAA. In 2020, GEICO also ranked highest among large insurers in the J.D. Power Insurance Shopping Study

SM

There are other reasons to choose GEICO car insurance. One independent survey on Insure.com found 44 percent of customers chose GEICO auto insurance based on price, while 19 percent chose the provider for its reputation in the industry. GEICO is, after all, a highly recognized name. An overwhelming majority said they would renew.

In the customer reviews we found, some were pleased with the professionalism of the GEICO auto insurance adjusters.

GEICO Car Insurance Customer Reviews

On GEICO’s BBB page, common complaints included slow claims processing and poor roadside assistance experiences. While the company may have low Trustpilot and BBB customer review scores, this does not necessarily indicate poor customer service. Both scores are based on fewer than 500 reviews – less than one percent of GEICO’s total customers.

We combed through GEICO auto insurance reviews across a range of sites and found that many mention the quality of GEICO’s website and service agents. However, GEICO customer service is not always consistent. Below is a representative sample of GEICO auto insurance reviews:

“I have been a policyholder for 18 years. The service on the website is great. It is simple to use and easy to understand. I have had problems with claims. I have had several claims in the past with the company and service has been iffy... I think they have lost the luster, and service has become less important as time went on. At least the website is easy and hassle-free.” – Mickey W. via Trustpilot

“I was involved in an accident while on vacation in Florida last month. The Florida GEICO adjuster was extremely helpful, professional, and caring. Thanks to her, I was able to continue my trip without worrying about being treated fairly. She was honest about what I could expect and was very familiar with both Florida law and my New York policy. All of my questions were answered in a timely fashion and eased my mind... As far as I’m concerned, GEICO has won a customer for life due to her professionalism and the service the company provides.” – MauiJim (GEICO customer of 6–9 years)

Conclusion: Best Overall Car Insurance

GEICO is a company that embraces mobile technology and makes coverage affordable through a number of discounts and programs. Many customers are attracted to GEICO for its reputation, but as with most insurance companies, some end up disappointed with aspects of the claims process and customer service.

Based on our research, we think GEICO is the Best Overall car insurance provider, as the company performs well in the majority of our research categories. To see how much GEICO auto insurance would cost for you and compare rates to other insurers in your area, get free quotes by entering your ZIP code into the form below.

Floating bar

-

Latest

Buick Avista concept car unveiled

Buick Avista concept car unveiledBuick showed off the Avista concept car in Detroit, because the North American International Auto Show this week started with a press preview. The 2+2 coupe attracted a lot of attention on the Cobo Ce...

-

Next

2022 Infiniti QX60 overview: trim level, new technical features, pricing, etc.

2022 Infiniti QX60 overview: trim level, new technical features, pricing, etc.In 2022, the Infiniti QX60 is described by automakers as a product that offers the "best of both worlds". In essence, Infiniti means that the QX60 is stylish in appearance, but has all the latest and...

Popular Articles

- Car buyers willing to redouble their efforts to buy a car

- Hyundai Canada announces adjustment of its marketing department

- Mercedes-Benz Canada announces comprehensive Mercedes-EQ charging strategy

- GM extends OnStar automotive insights to non-GM

- Kia Canada enhances buyer knowledge at new electric vehicle experience center in Vancouver

- Mitsubishi Motors launches digital showroom